I wanted to share how I keep tabs on my finances. In the book, The Millionaire Next Door, it says every month millionaires spend a minimum of eight hours looking at their personal investments. It’s clear that part of financial success involves continually watching the store.

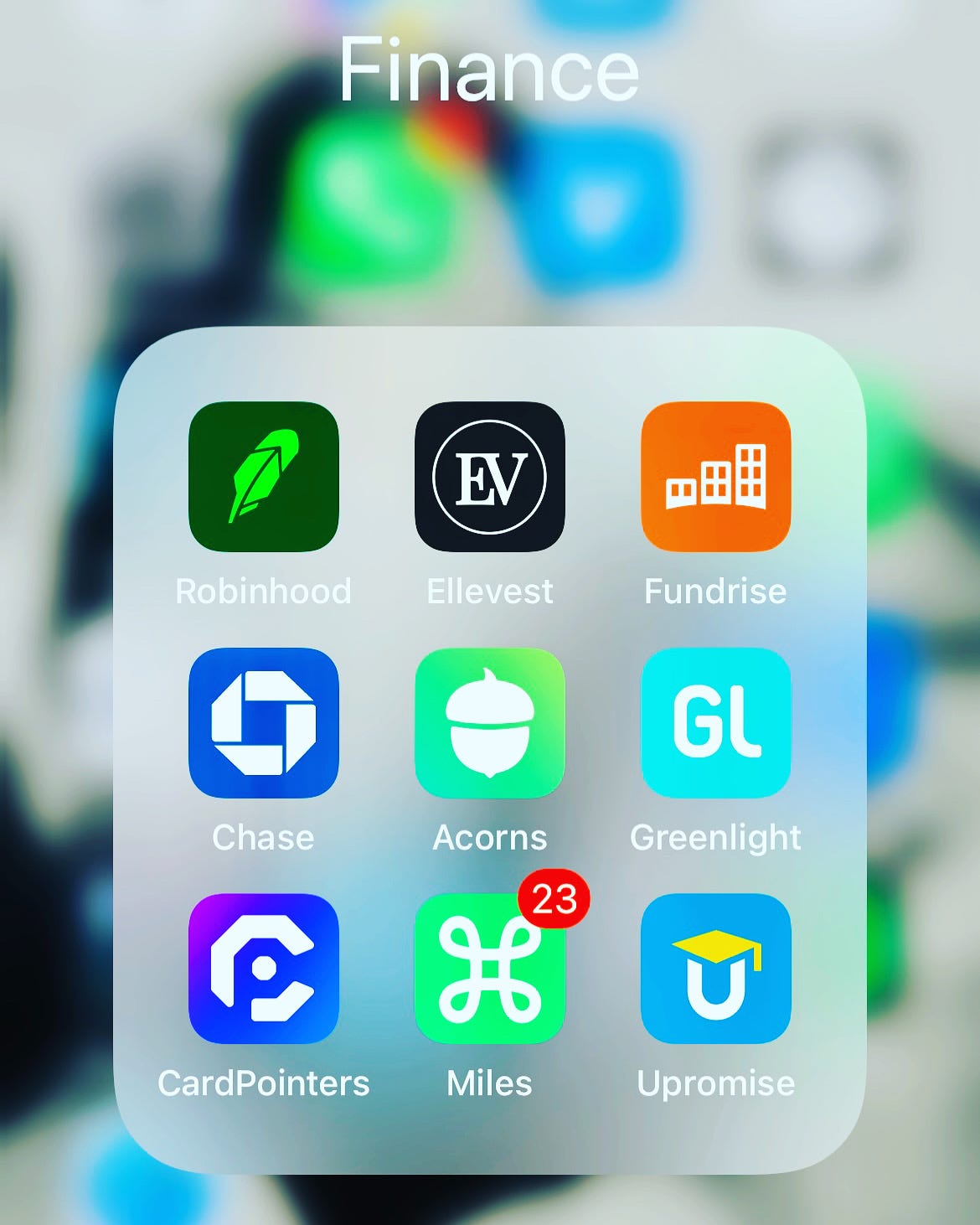

Here’s a breakdown of the apps I use to do just that:

Robinhood: A simple investment app. I don’t trade much because doing so assumes I know more than experts but I teach myself and my daughters how it all works by trading small amounts of fractional shares here. I put in $5 a week and in 25 years, based on rate of return averages, I’ll likely have $28,343.

Ellevest: This is where I house my Roth, 401k, SEP, emergency savings and build wealth accounts.

Their female-owned company invests my money and teaches me about how it all works through weekly emails, workshops, and 1:1 counseling when I need it. According to market averages, my retirement income will be $563,668 in 12 years.

Fundrise: This is a fun platform that allows me to collectively buy in on real estate projects across the country. I invest $80 a month and in 20 years I expect to have $69,942.

Chase: This banker houses my personal and business checking accounts. I do not use debit cards because they don’t do anything for me, but withdrawals come out, mainly to fund investments or to pay off credit cards in full each month.

Acorns: This is my favorite way to see how a little savings goes a long way. I round up change from all of my accounts plus fund it at a rate of $5 a week. Milla has a kid’s account here and funds hers at a rate of $24 per month. If she keeps at it until she retires she will have $280,182.

Greenlight: This is how I pay Milla her allowance each week. She gets $12 a week and her account is tied to a debit card Mastercard so she can make purchases around town without me. I can see and track everything and can immediately shut down the card if it is lost or stolen. This is a way for her to get used to making financial transactions in the world.

Card Pointers: I’d like to talk about this app more when I talk about credit card miles and points, but basically it tracks all my cards and shows me when deals and offers are available and expiring so I can make the most of my purchasing power. I find it indispensable.

Miles: This app gives me points every time I walk or drive and then those points can be redeemed for deals and discounts from participating merchants. It’s an easy way to get free stuff. And sure, they track me, but the upside is so great I don’t care.

UPromise: This company has been around forever and it’s an incremental way to save money for college. It’s not a windfall but it can amount to $3000 once your kiddo is ready to go to college. They offer a nice bonus if you link your kiddo’s 529 with them.

So there you have it. One little app folder garnering me almost a million ($945,185) in investments for retirement. Now I know why they call these things smart phones.

Reach out if you need a promo code for any of these apps. I’ll also put them in my @linktr.ee on Instagram @sheisstocked.

Hi Kate, I’m a longtime reader and have been intrigued about your financial tips and advice. I’m wondering if we could have a private conversation so that I can get started on some good strategies. I’m a local Boulder foodie cook, too. Thanks, Carol Carlson